CFT PERFORMANCES 2021

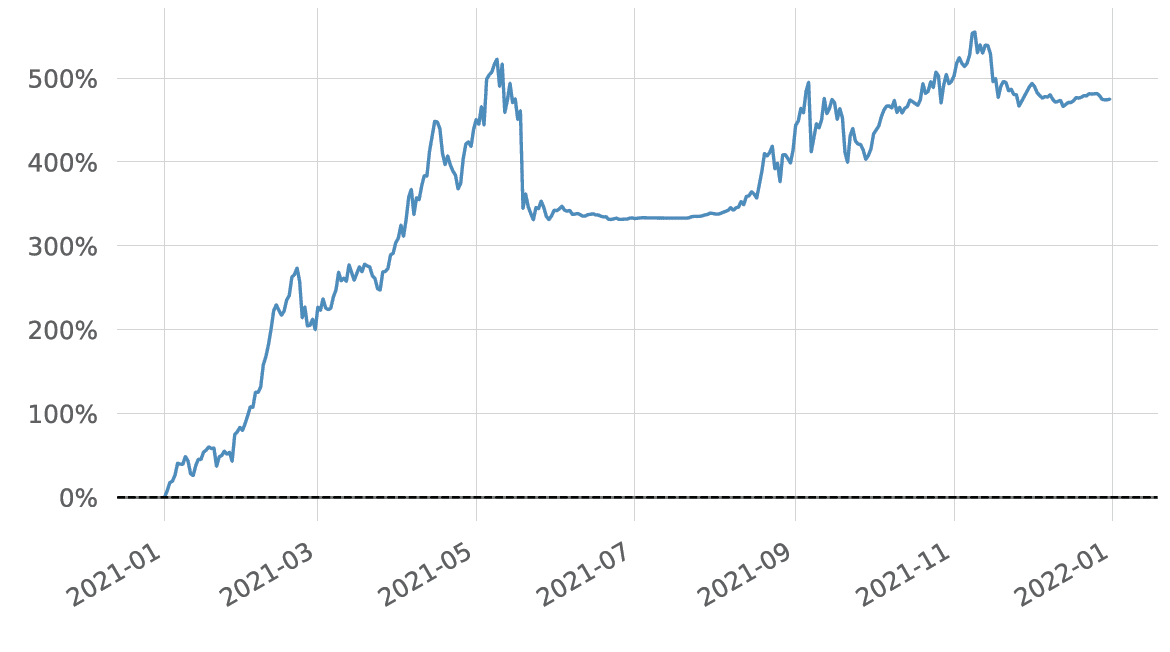

Cumulative Returns vs Benchmark

(Proprietary Execution, Multi-Asset Strategy)

In 2021, our internal execution framework navigated intense crypto volatility, producing a remarkable gross annual return of +436.34% across 12 crypto pairs. This sharply outperformed Bitcoin’s +59.3% return over the year.

The multi-asset approach, executed without leverage and rigorously risk-controlled, illustrates C.FT Ltd’s ability to consistently deliver superior results through disciplined trading and strategic asset rotation.

Key Metrics:

- Annual Return: +436.34%

- Sharpe Ratio: 5.90

- Assets Traded: 12 crypto pairs

📥 Download Full 2021 Performance PDF (Enter your email address for immediate access)

⚠️ Disclaimer: These results reflect only proprietary trades executed with C.FT Ltd’s own capital. They do not represent any client portfolio, investment product, or financial advice.

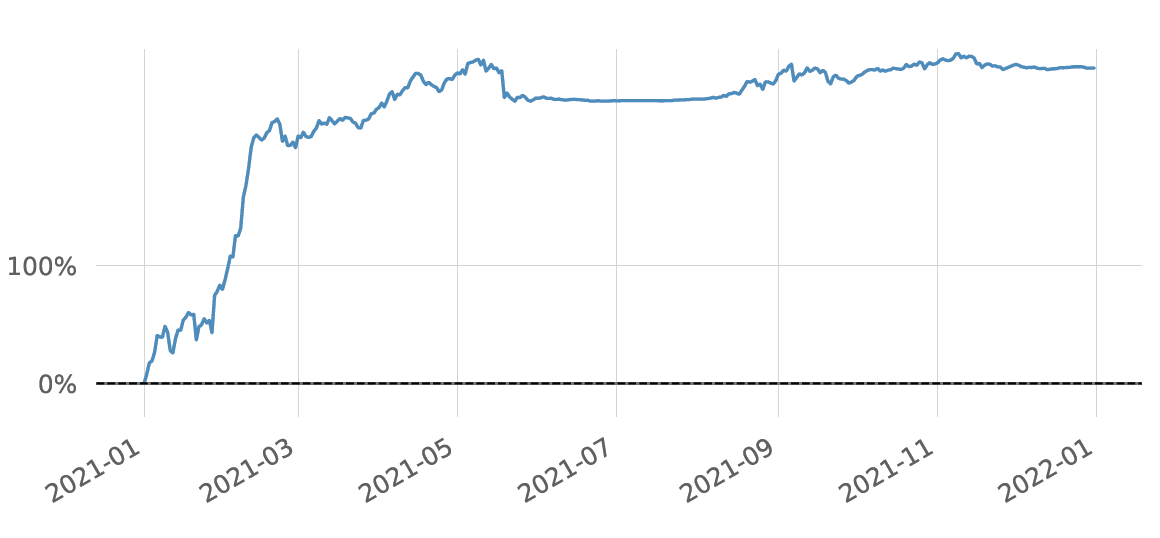

Log-Scale Cumulative Returns

(Consistent Performance Through Volatility)

The logarithmic scale chart emphasizes the robustness and consistency of our multi-asset trading strategy throughout the year. Despite sharp market corrections and rallies, our internal infrastructure systematically mitigated risks, demonstrating significant resilience and delivering sustained outperformance.

Our proprietary execution technology is continuously refined to ensure stability and precise risk management—key components for institutional investors seeking reliable performance metrics.

📥 Get Full 2021 Log-Scale Analysis (Provide your email for instant download)

⚠️ Legal Notice: These figures are derived exclusively from C.FT Ltd’s internal operations. They do not reflect client performance and should not be interpreted as advice, an offer, or a forecast. This data is shared for technical transparency only.

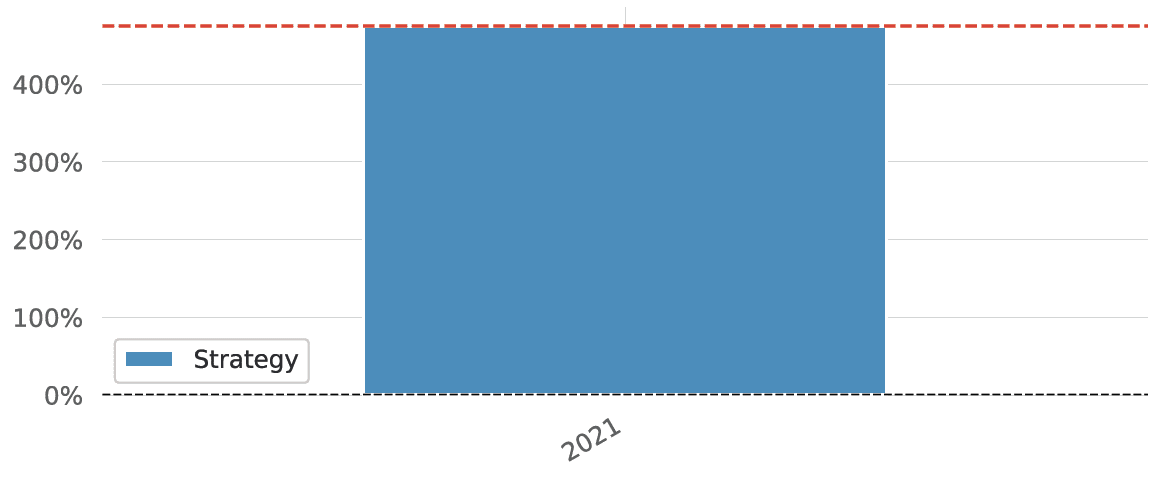

Year-End Results

(Annual Performance Summary)

The conclusion of 2021 saw C.FT Ltd achieve a strong +436.34% return, significantly exceeding the Bitcoin benchmark (+59.3%).

This outcome highlights our proprietary infrastructure’s effectiveness in capturing optimal market conditions through technical rigor and precise execution, even during turbulent market cycles.

📥 Access Complete 2021 Annual Report (Enter your email to receive it immediately)

⚠️ Regulatory Note: C.FT Ltd does not provide investment management or discretionary services. The results shown are strictly internal and are published for the sole purpose of illustrating execution capabilities.

GET THE FULL REPORT

Access the complete information about CFT’s performances.