Although holders of both bitcoin (BTC) and gold are often motivated by an idea of investing in assets that are outside of the financial system, it might not be the case, according to a popular macro strategist who believes that that the next world reserve currency will be “a crypto.”

Speaking with Anthony Pompliano, Morgan Creek Digital Co-founder and the host of Pomp Podcast, Jim Bianco, President and Macro Strategist at Bianco Research, a macro investment analysis firm, said that bitcoin does have potential to be a real hedge against the current system, but that would first require adoption by merchants, making it possible to “do something real” with the bitcoin.

Speaking about bitcoin as a medium of exchange, Bianco said “I can’t do anything with it until I change it back to dollars and buy groceries with it, so I’m still kind of stuck in the same system that I’m trying to get out of,” referring to the fact that most merchants still don’t accept bitcoin or other cryptocurrencies as payment.

However, Bianco also made it clear that bitcoin still has potential if real-world adoption increases:

“When I can do something real with it, outside of the financial system, then you’ve got something […] that would really be the game-changer.”

Despite not being overly enthusiastic about bitcoin at present, however, Bianco did say that he believes the next world reserve currency after the US dollar “will be a crypto.”

“For a half-second, I thought maybe Libra will do it,” Bianco admitted, before explaining how it represented too big of a threat to government fiat currencies to be accepted by the same governments “because they were afraid of what Libra represented.” He went on to say that although the next reserve currency will be a crypto,“it probably doesn’t exist yet.”

Bianco continued by explaining that the next reserve currency needs to be both a medium of exchange and a store of value, which in his view bitcoin is not.

“Bitcoin might be a good store of value, but it’s not a really good medium of exchange,” he said.

In either case, the strategist is not entirely correct when he says that he can’t do anything with BTC.

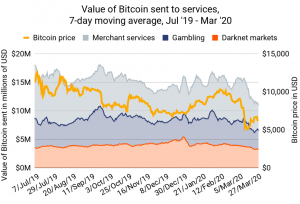

Just recently, analysts at blockchain analytics specialist Chainalysis were surprised by the resilience of the bitcoin merchant services amid the coronavirus-caused economic crisis.

The analysts said that one reason behind the smaller than expected drop in merchant services activity could be that people have continued using their crypto to buy through merchant services those essentials that they can’t buy elsewhere with fiat.

However, on a global scale, BTC is not ready to replace fiat money, Dominik Stroukal, Economics Expert at SatoshiLabs, the manufacturer of the Trezor wallet, said in a separate blog post yesterday.

“At least not yet. It does not have the capacity and infrastructure to do so. You cannot have exaggerated expectations. However, cryptocurrencies change every day for the better. The technology is evolving, and privacy and security are getting better every day,” he said, adding that a crisis like the current one attracts people to seek alternatives and accelerates the development.

Meanwhile, Bianco also drew a similar conclusion on gold, saying that people who buy gold because they believe inflation or other “bad things” are going to happen to the financial system should keep in mind that they are not really getting out of that system, unless they own physical gold, e.g., in coins.

“That is the problem that gold has right now […] it’s not as separate as people make it out to be,” he said, while explaining that gold is subject to the volatility of the traditional financial system via its futures contracts traded on the COMEX and other futures exchanges, and via the popular GLD exchange-traded fund traded on the New York Stock Exchange.